By Edmund Siau, Anshari Rahman, Ali Izadi-Najafabadi, Leonard Quong, Caroline Chua, Sahaj Sood

Asia Pacific is central to global energy sector decarbonisation and the world’s transition to net zero. The region saw energy-related emissions grow 151% between 2000 and 2023, driven by strong economic development, population growth and industrialisation. However, emissions will need to peak and rapidly reduce if the world is to achieve the goals of the Paris Agreement.

Countries must act immediately to decarbonise along a Paris-aligned emissions trajectory. The window to reach net-zero emissions by 2050 is rapidly closing, although immediate and accelerated action could still put Asia Pacific on track. In BloombergNEF’s Net Zero Scenario, global warming is limited to 1.75°C by the end of the century, in line with the goals of the Paris Agreement of well below 2°C of global warming. Governments need to double down and accelerate decarbonisation efforts in the next decade, starting immediately, or risk missing their climate goals. Achieving net zero by 2050 requires India, Indonesia and Vietnam to reach peak emissions 12 to 18 years earlier than under BNEF’s Economic Transition Scenario.

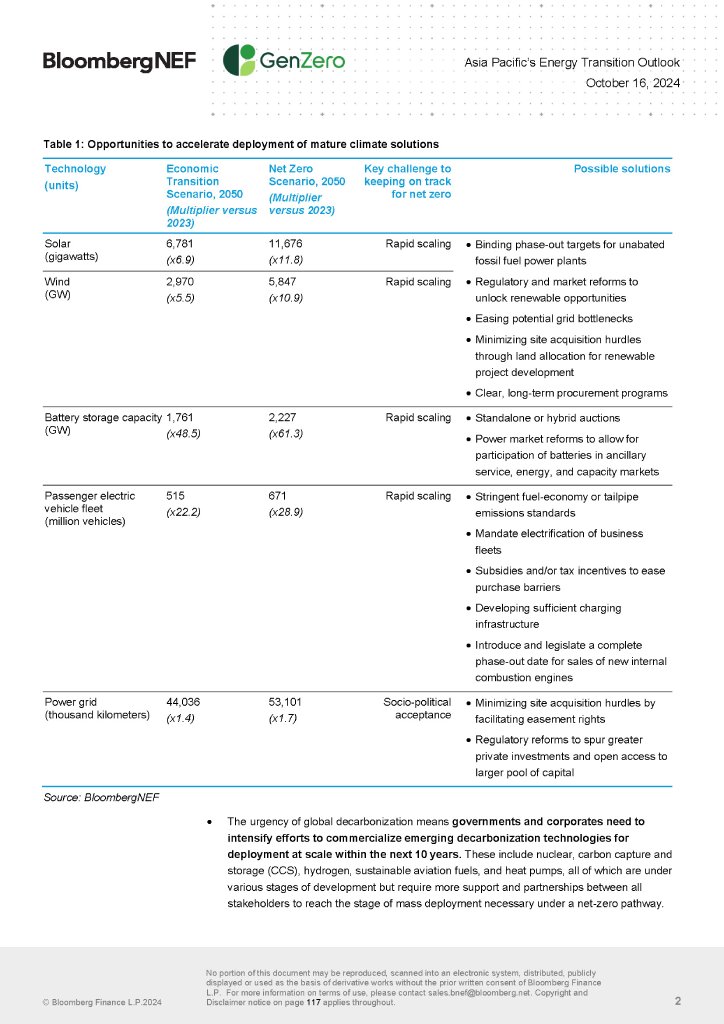

Today, mature, commercially scalable technologies with proven business models already exist. These include electric vehicles, renewable power, energy storage, and power grids, all of which require a significant acceleration to get on track for net zero, but bear little to no technology risk and economic premiums are generally small or non-existent. Reducing emissions from the power sector is of utmost priority and can be implemented immediately with an accelerated scaling of low-carbon technologies and a swift end to financing of new unabated fossil fuel plants. Clean power alone could abate 50% of Asia Pacific’s cumulative emissions between 2024 and 2050. However, some markets may still face regulatory and infrastructure barriers as well as bottlenecks that can impede clean power deployment. Policymakers will need to address these challenges.

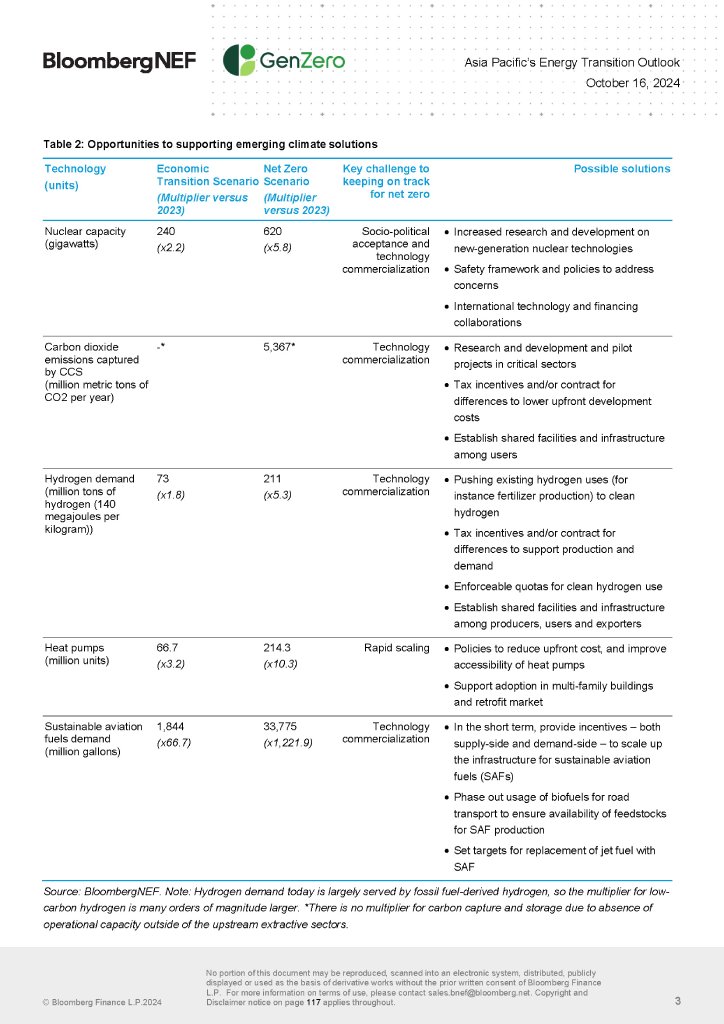

Governments and corporates need to intensify efforts to commercialise emerging decarbonisation technologies for deployment at scale within the next 10 years. These include nuclear, carbon capture and storage (CCS), hydrogen, sustainable aviation fuels, and heat pumps, all of which are under various stages of development but require more support and partnerships between all stakeholders to reach the stage of mass deployment necessary under a net-zero pathway.

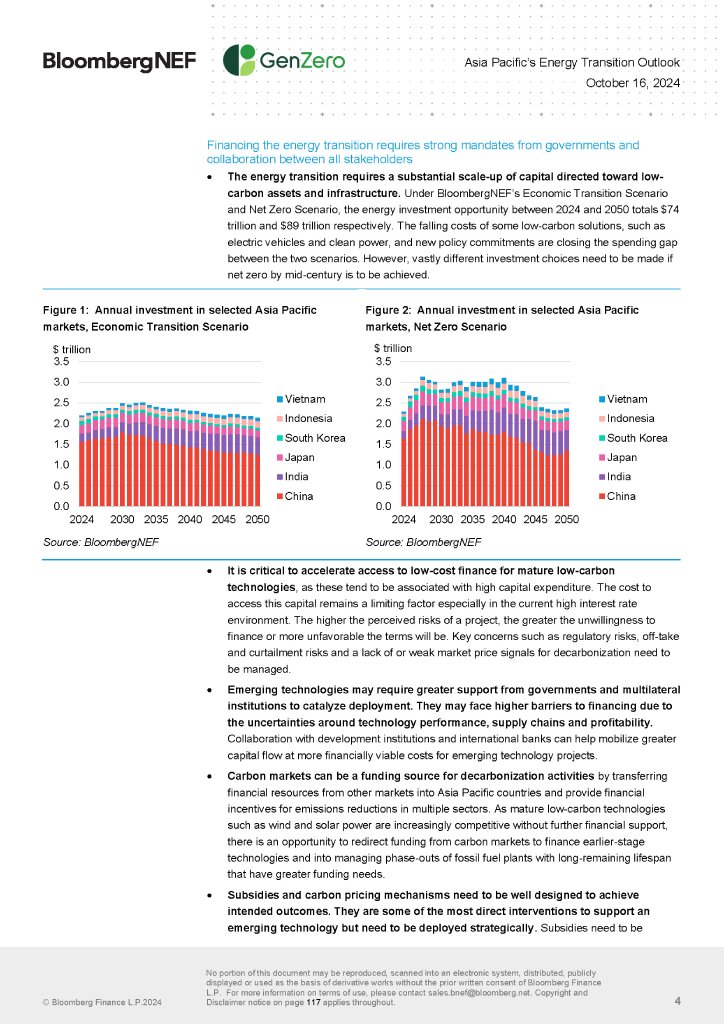

Financing the energy transition requires strong mandates from governments and collaboration between all stakeholders. The energy transition requires a substantial scale-up of capital directed toward low-carbon assets and infrastructure. Under BloombergNEF’s Economic Transition Scenario and Net Zero Scenario, the energy investment opportunity between 2024 and 2050 totals US$74 trillion and US$89 trillion respectively. The falling costs of some low-carbon solutions, such as electric vehicles and clean power, and new policy commitments are closing the spending gap between the two scenarios. However, vastly different investment choices need to be made.

It is critical to accelerate access to low-cost finance for mature low-carbon technologies, as these tend to be associated with high capital expenditure. The cost to access this capital remains a limiting factor especially in the current high interest rate environment. Key concerns such as regulatory risks, off-take and curtailment risks and a lack of or weak market price signals for decarbonisation need to be managed.

Emerging technologies may require greater support from governments and multilateral institutions to catalyse deployment. They may face higher barriers to financing due to the uncertainties around technology performance, supply chains and profitability. Collaboration with development institutions and international banks can help mobilise greater capital flow at more financially viable costs for emerging technology projects.

Carbon markets can be a funding source for decarbonisation activities by transferring financial resources from other markets into Asia Pacific countries and providing financial incentives for emissions reductions. As mature low-carbon technologies such as wind and solar power are increasingly competitive without carbon finance, there is an opportunity to redirect funding from carbon markets to finance earlier-stage technologies and into managing phase-outs of fossil fuel plants with long-remaining lifespan that have greater funding needs.

Subsidies and carbon pricing mechanisms are some of the most direct interventions to support emerging technologies but need to be deployed strategically. Subsidies need to be targeted into sectors that need them in the short term, and need to be phased out when financial support for the technology is no longer required to avoid over-reliance on government support in the long run. Carbon pricing mechanisms need to be sufficiently high, cover a significant share of emissions, and without overly generous concessions that could negate incentives for companies to abate emissions.

Acknowledgments

This report, commissioned by GenZero, is the copyright of Bloomberg Finance L.P. in connection with BloombergNEF.

© Bloomberg Finance L.P. 2024. All Rights Reserved.