By Edmund Siau, Anshari Rahman

Carbon pricing is an essential tool to accelerate climate action. Net-zero pledges now cover 88% of global greenhouse gas (GHG) emissions. However, the world remains off-track from pathways that limit global warming to 1.5 °C. This gap needs to be bridged by effective policies and measures. In this context, carbon pricing becomes a key lever to accelerate decarbonisation by factoring in a cost to emit, thus incentivising businesses and individuals to reduce their carbon footprint.

Carbon markets are a flexible and effective way to put a price on carbon. It is politically challenging to implement carbon pricing at levels high enough to drive transformational change. Prices need to balance external costs of emissions with economic goals and sustainable development priorities. Carbon markets help by providing a flexible way of pricing emissions which allocates capital to the most cost-effective abatement measures, and improves the economics of nascent solutions in hard-to-abate sectors.

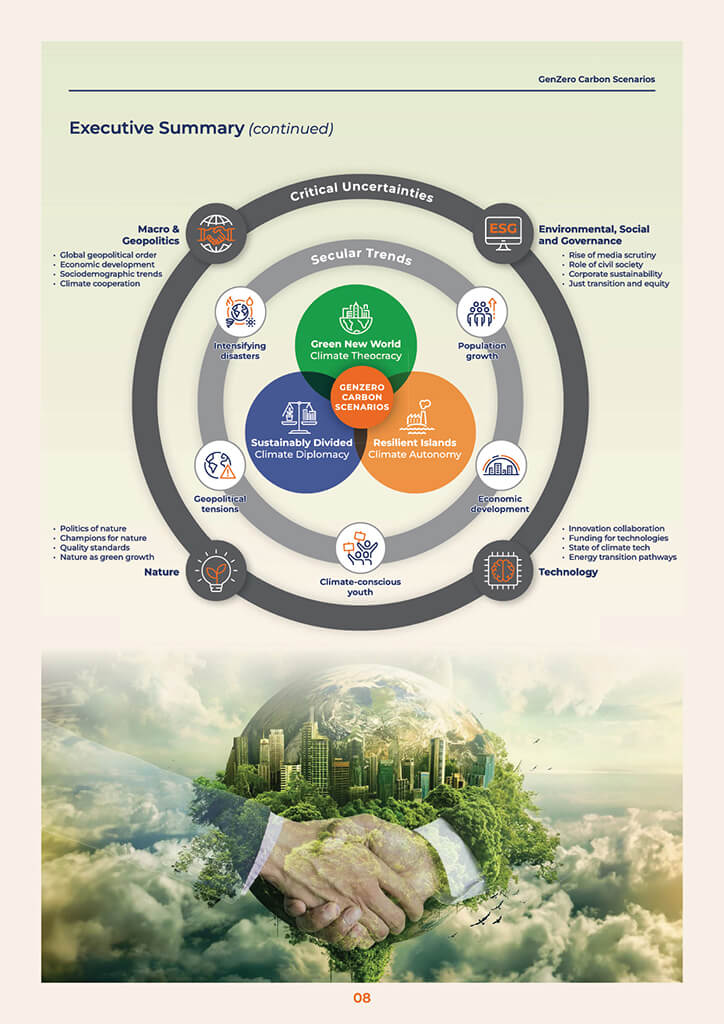

However, the outlook for carbon markets is highly uncertain. There are many critical uncertainties that affect carbon markets. Several of these are already playing out in the real world. For example, geopolitical and macroeconomic headwinds have caused countries and corporates to scale back climate action in the face of competing priorities (e.g. inflation, resilience, and security). Carbon markets are also facing questions about environmental integrity at the supply, demand, and system level.

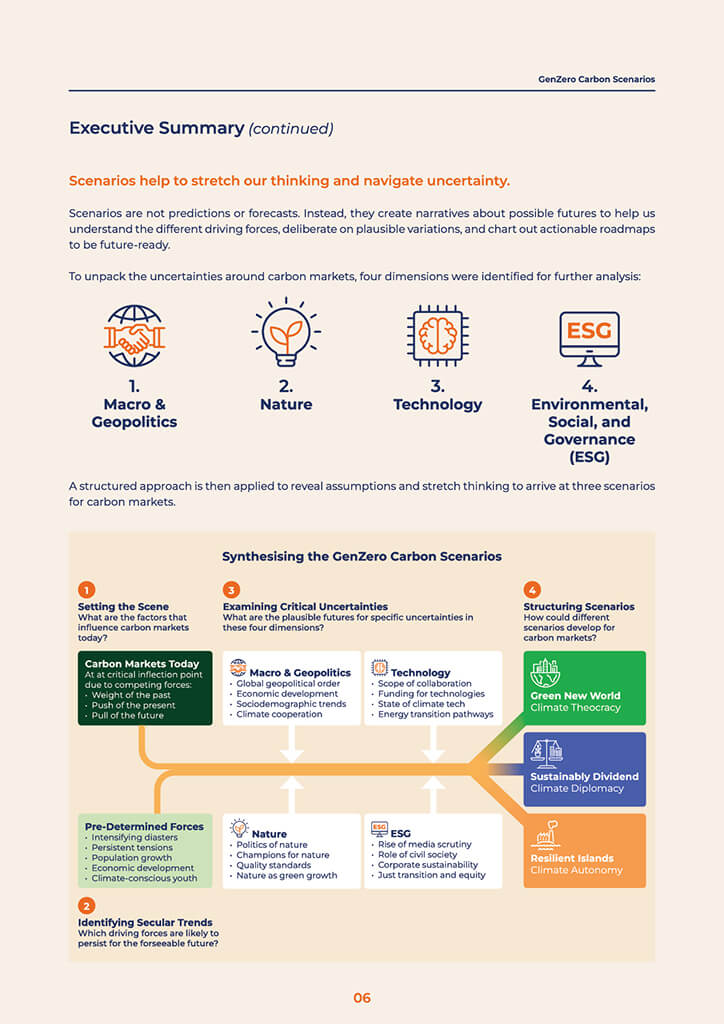

Scenarios help to stretch our thinking and navigate uncertainty. Scenarios are not predictions or forecasts. Instead, they create narratives about possible futures to help us understand the different driving forces, deliberate on plausible variations, and chart out actionable roadmaps to be future-ready.

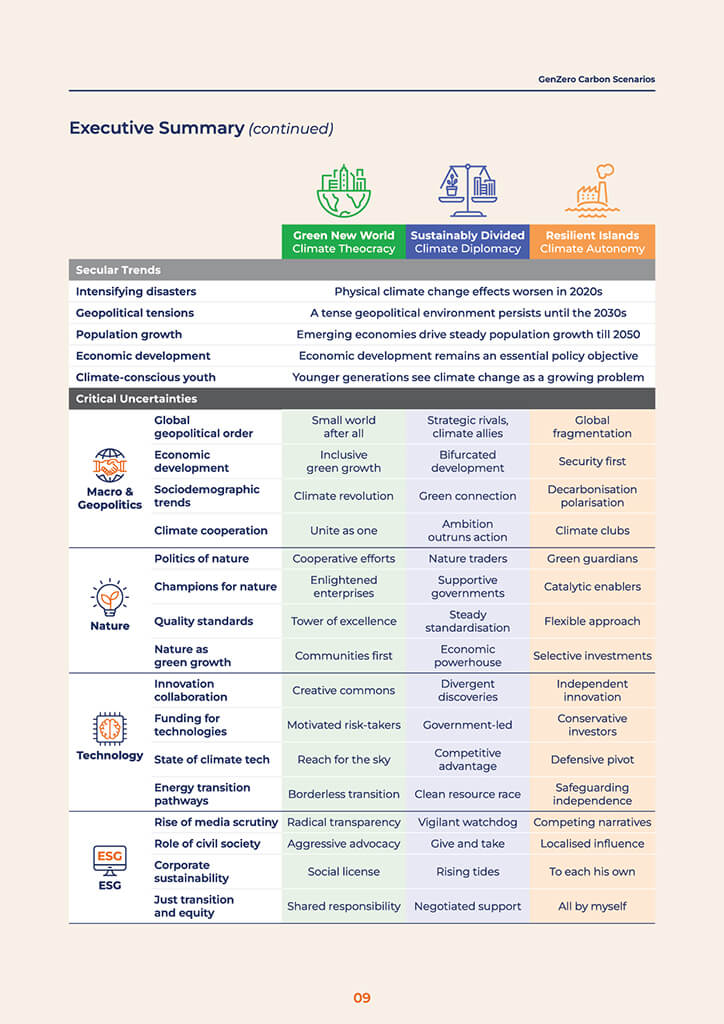

Three distinct, logically consistent scenarios are identified and detailed with narratives. Looking across the multiple drivers of change and how they could play out differently, several distinct scenarios for future carbon markets can be discerned:

- Green New World: Climate Theocracy – Faced with devastating impacts of climate change, climate cooperation becomes a top global priority

- Sustainably Divided: Climate Diplomacy – Despite extreme weather events, geopolitical contestation results in bifurcated decarbonisation

- Resilient Islands: Climate Autonomy – Climate disasters strain international cooperation and result in fragmented climate action

We see three no-regrets actions that can be taken today. These are irrespective of the trajectory of carbon markets, be it towards harmonisation, bifurcation, or fragmentation. These actions include:

- Supporting the development of regulatory oversight in carbon markets

- Providing clarity on the role of carbon markets in decarbonisation pathways

- Leveraging digitalisation as a tool to enable integrity at scale and restore confidence

This paper aims to share learnings from our scenario planning exercise to encourage investors, policymakers, and industry leaders to discuss the critical driving forces, strategic pivots, and key imperatives we need to make, and ensure we have an effective pathway towards our decarbonisation objectives.

Acknowledgments

The authors are grateful to the many industry leaders who have provided their input for this report.

© Carbon Solutions Platform Pte. Ltd. All Rights Reserved.

The companies in which Carbon Solutions Platform Pte. Ltd. directly and indirectly owns investments are separate legal entities. In this article and presentation, “GenZero” is sometimes used for convenience where references are made to Carbon Solutions Platform Pte. Ltd. and its subsidiaries in general.